In December 2023, the demand for steel in the Chinese market continued to weaken, but the intensity of steel production also weakened significantly, supply and demand were stable, and steel prices continued to rise slightly. Since January 2024, steel prices have turned from rising to falling.

According to monitoring by the China Iron and Steel Industry Association, at the end of December 2023, the China Steel Price Index (CSPI) was 112.90 points, an increase of 1.28 points, or 1.15%, from the previous month; a decrease of 0.35 points, or 0.31%, from the end of 2022; a year-on-year decrease of 0.35 points, the decrease was 0.31%.

Judging from the full-year situation, the average CSPI domestic steel price index in 2023 is 111.60 points, a year-on-year decrease of 11.07 points, a decrease of 9.02%. Looking at the monthly situation, the price index rose slightly from January to March 2023, turned from rising to falling from April to May, fluctuated in a narrow range from June to October, rose significantly in November, and narrowed the increase in December.

(1) The prices of long plates continue to rise, with the increase in plate prices being greater than that of long products.

At the end of December 2023, the CSPI long product index was 116.11 points, a month-on-month increase of 0.55 points, or 0.48%; the CSPI plate index was 111.80 points, a month-on-month increase of 1.99 points, or 1.81%. The increase in plate products was 1.34 percentage points greater than that in long products. Compared with the same period in 2022, the long product and plate indexes fell by 2.56 points and 1.11 points respectively, with decreases of 2.16% and 0.98% respectively.

Looking at the full-year situation, the average CSPI long product index in 2023 is 115.00 points, a year-on-year decrease of 13.12 points, a decrease of 10.24%; the average CSPI plate index is 111.53 points, a year-on-year decrease of 9.85 points, a decrease of 8.12%.

(2) The price of hot rolled steel seamless pipes dropped slightly month-on-month, while the prices of other varieties increased.

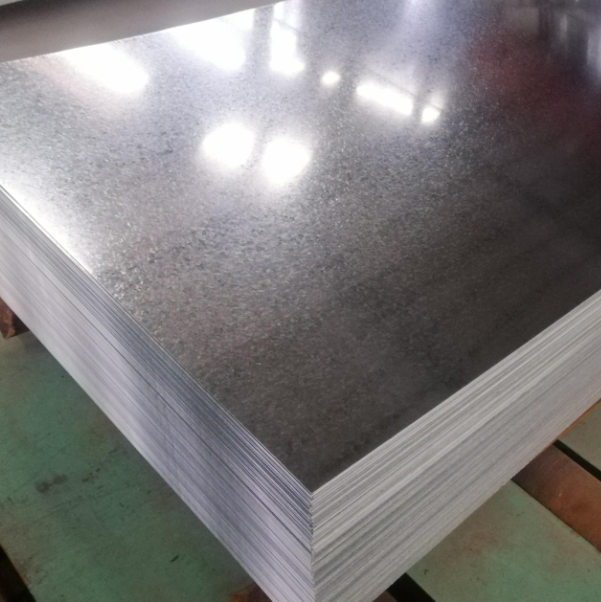

At the end of December 2023, among the eight major steel varieties monitored by the Iron and Steel Association, except for the price of hot rolled steel seamless pipes, which dropped slightly month-on-month, the prices of other varieties have increased. Among them, the increases of high wire, rebar, angle steel, medium and thick plates, hot rolled steel in coils, cold rolled steel sheets and galvanized sheets were 26 rmb/ton, 14 rmb/ton, 14 rmb/ton, 91 rmb/ton, 107 rmb/ton, 30 rmb/ton and 43 rmb/ton; the price of hot rolled steel seamless pipes dropped slightly, by 11 rmb/ton.

Judging from the full-year situation, the average prices of the eight major varieties of steel in 2023 are lower than in 2022. Among them, the prices of high-end wire, rebar, angle steel, medium and thick plates, hot rolled coils, cold rolled steel sheets, galvanized steel sheets and hot rolled seamless pipes dropped by 472 rmb/ton, 475 rmb/ton, and 566 rmb/ton 434 rmb/ton, 410 rmb/ton, 331 rmb/ton, 341 rmb/ton and 685 rmb/ton respectively.

Steel prices continue to rise in the international market

In December 2023, the CRU international steel price Index was 218.7 points, a month-on-month increase of 14.5 points, or 7.1%; a year-on-year increase of 13.5 points, or a year-on-year increase of 6.6%.

(1) The price increase of long products narrowed, while the price increase of flat products increased.

In December 2023, the CRU long steel index was 213.8 points, a month-on-month increase of 4.7 points, or 2.2%; the CRU flat steel index was 221.1 points, a month-on-month increase of 19.3 points, or a 9.6% increase. Compared with the same period in 2022, the CRU long steel index fell by 20.6 points, or 8.8%; the CRU flat steel index increased by 30.3 points, or 15.9%.

Looking at the full-year situation, the CRU long product index will average 224.83 points in 2023, a year-on-year decrease of 54.4 points, a decrease of 19.5%; the CRU plate index will average 215.6 points, a year-on-year decrease of 48.0 points, a decrease of 18.2%.

(2) The increase in North America narrowed, the increase in Europe increased, and the increase in Asia turned from decline to increase.

North American market

In December 2023, the CRU North American Steel Price Index was 270.3 points, a month-on-month increase of 28.6 points, or 11.8%; the U.S. manufacturing PMI (Purchasing Managers Index) was 47.4%, a month-on-month increase of 0.7 percentage points. In the second week of January 2024, the U.S. crude steel production capacity utilization rate was 76.9%, an increase of 3.8 percentage points from the previous month. In December 2023, the prices of steel bars, small sections and sections at steel mills in the Midwest of the United States remained stable, while the prices of other varieties increased.

European market

In December 2023, the CRU European steel price index was 228.9 points, up 12.8 points month-on-month, or 5.9%; the final value of the Eurozone manufacturing PMI was 44.4%, the highest point in seven months. Among them, the manufacturing PMIs of Germany, Italy, France and Spain were 43.3%, 45.3%, 42.1% and 46.2% respectively. Except for France and Spain, prices fell slightly, and other regions continued to rebound month-on-month. In December 2023, the prices of medium-thick plates and cold-rolled coils in the German market turned from falling to rising, and the prices of other varieties continued to rise.

Asia market

In December 2023, the CRU Asia Steel Price Index was 182.7 points, an increase of 7.1 points or 4.0% from November 2023, and turned from a decrease to an increase month-on-month. In December 2023, Japan's manufacturing PMI was 47.9%, a month-on-month decrease of 0.4 percentage points; South Korea's manufacturing PMI was 49.9%, a month-on-month decrease of 0.1 percentage points; India's manufacturing PMI was 54.9%, a month-on-month decrease of 1.1 percentage points; China's manufacturing industry The PMI was 49.0%, down 0.4 percentage points from the previous month. In December 2023, except for the price of hot-rolled coils in the Indian market, which turned from falling to rising, the prices of other varieties continued to decline.

Post time: Jan-26-2024