In January, China's steel market entered the traditional off-season of demand, and the intensity of steel production also declined. Overall, supply and demand remained stable, and steel prices oscillated slightly down. Into February, steel prices were narrow downward trend.

China's steel price index falls slightly year-on-year

According to the China Iron and Steel Industry Association monitoring, at the end of January, the China Steel Price Index (CSPI) was 112.67 points, down 0.23 points, or 0.20 percent; year-on-year decline of 2.55 points, or 2.21 percent.

Changes in prices of major steel varieties

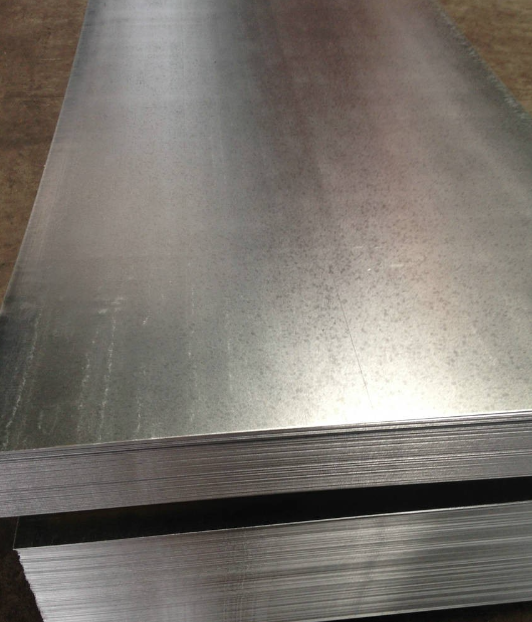

At the end of January, the steel association to monitor the eight major steel varieties, plate and hot rolled coil prices rose slightly, up 23 RMB/ tonne and 6 RMB/ tonne; hot rolled steel seamless pipe prices from decline to rise, up 46 RMB/ tonne; other varieties of prices from rise to fall. Among them, high wire, rebar, angle steel, cold rolled steel sheet and galvanized steel sheet prices fell 20 RMB/ tonne, 38 RMB/ tonne, 4 RMB/ tonne, 31 RMB/ tonne and 16 RMB/ tonne.

CSPI weekly price index changes.

In January, the overall domestic steel composite index showed a shocking downward trend, and since entering February, the steel price index has continued to decline.

Changes in the steel price index by region.

In January, the CSPI six major regions of the steel price index rose and fell. Among them, East China, Southwest China and Northwest China index from rise to fall, down 0.57%, 0.46% and 0.30%; North China, Northeast China and Central and South China price index rose 0.15%, 0.08% and 0.05%, respectively.

Steel Prices Vibrate Downward

From the downstream steel industry operation, the domestic steel market into the traditional demand off-season, the demand is less than expected, steel prices appear to vibrate downward trend.

From the raw fuel point of view, at the end of January, the domestic iron ore concentrate prices ring narrowed the rate of increase of 0.18 per cent, coking coal, metallurgical coke and blown coal prices fell by 4.63 per cent, 7.62 per cent and 7.49 per cent, respectively; scrap prices rose slightly from the previous year, an increase of 0.20 per cent.

Steel prices continue to rise in the international market

In January, the CRU international steel price index was 227.9 points, up 9.2 points, or 4.2%; year-on-year increase of 11.9 points, or 5.5%.

Long steel prices rose narrowly, plate prices increased

In January, CRU long steel index was 218.8 points, up 5.0 points, or 2.3%; CRU plate index was 232.2 points, up 11.1 points, or 5.0%. Compared with the same period last year, the CRU Long Products Index decreased by 21.1 points, or 8.8 per cent; the CRU Plate Index increased by 28.1 points, or 13.8 per cent.

The North American, European and Asian steel indices all continued to recover.

1. North American market

In January, CRU North America steel price index was 289.6 points, 19.3 points, or 7.1%; U.S. manufacturing PMI (Purchasing Managers' Index) was 49.1%, up 2.0 percentage points. January, the U.S. Midwest steel mills steel varieties prices have risen.

2. European market

In January, the CRU European steel price index was 236.6 points, a rebound of 7.7 points, or 3.4%; the final value of the euro zone manufacturing PMI was 46.6%, exceeding expectations of 44.7%, a new high in nearly nine months. Among them, Germany, Italy, France and Spain's manufacturing PMI were 45.5 per cent, 48.5 per cent, 43.1 per cent and 49.2 per cent, France and Spain's index from decline to rise, other regions continue to rebound from the ring. in January, the German market prices of plate and cold rolled coil from decline to rise, the rest of the varieties of prices continue to rebound.

3. Asian markets

In January, CRU Asia steel price index was 186.9 points, up 4.2 points from December 2023, up 2.3%. Japan's manufacturing PMI was 48.0%, up 0.1 percentage points; South Korea's manufacturing PMI was 51.2%, up 1.3 percentage points; India's manufacturing PMI was 56.5%, up 1.6 percentage points; China's manufacturing PMI was 49.2%, a rebound of 0.2 percentage points. in January, India's market continued to decline in long steel prices, hot-rolled strip coils Prices rose steadily, the rest of the varieties of prices from decline to rise.

Analysis of steel prices in the latter part of the year

With the end of the Spring Festival holiday, the domestic steel market demand slowly recovered, and the steel inventory accumulated in the previous period will be gradually released. The trend of steel prices in the later period mainly depends on the changes in the intensity of steel production. For the time being, the short-term steel market or still a weak pattern of supply and demand, steel prices continue to fluctuate in a narrow range.

1.Supply and demand are both weak, steel prices fluctuated in a narrow range.

2.Steel mill inventory and social inventory increased.

Post time: Mar-06-2024