Information and Statistics Department, China Iron and Steel Industry Association

Steel production of key statistical steel enterprises in January was 62.86 million tons, up 4.6% year-on-year and 12.2% from December 2023. At the beginning of the New Year, the production of steel enterprises gradually recovered. in January, steel enterprises sold 61.73 million tons of steel, up 14.9% year-on-year, up 10.6% from December last year.

This year's Spring Festival holiday is relatively late compared to 2023, January sales of steel enterprises are basically normal, production and sales rate of 98.2%, compared with the same period in 2023 improved by 8.7 percentage points. However, at the same time, the current market demand is still low, steel orders are still poor, the production and sales rate continued to decline, and the production and sales rate compared with December 2023 fell 1.4 percentage points.

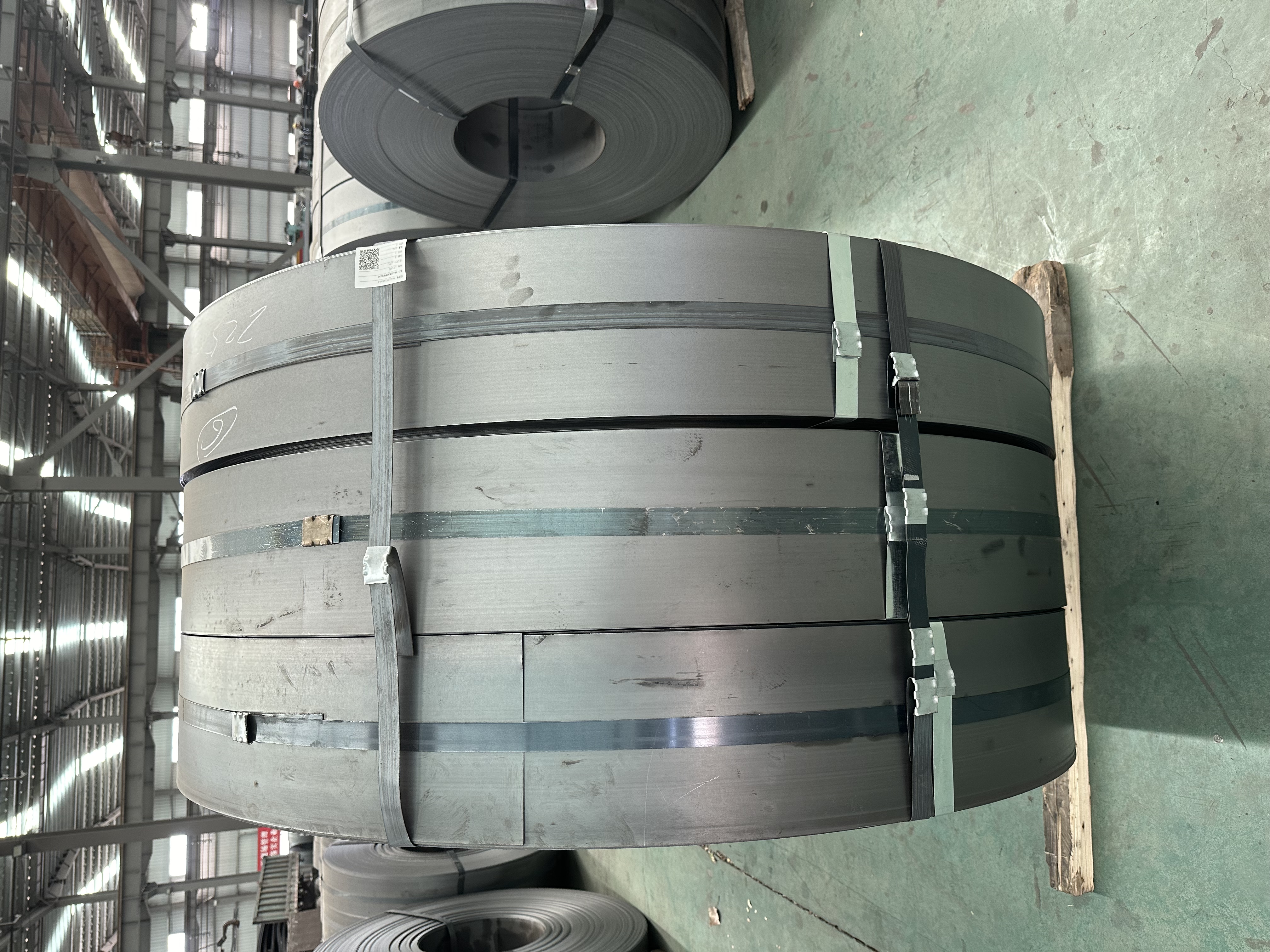

Plate and strip year-on-year increase is more obvious

In January, steel production was 62.86 million tons, an increase of 2.77 million tons, up 4.6%. Among them, the production accounted for a relatively large increase in plate and strip is more obvious, plate, color coated sheet and strip, hot rolled steel strip, such as more than 15% year-on-year growth; steel bars, and wire rod production is still declining. With the conversion of the market demand structure, the product structure of steel enterprises continued to be optimized.

Market demand for construction steel is expected to be high

Increased share of long products

In January, steel sales of 61.73 million tons, of which 56.95%, 40.19%, 1.62%, 0.54%, 0.7% of plate and strip, long steel, pipe, railroad steel, and other steel, respectively. With the continuous relaxation of real estate policies around the world, especially the construction of protected housing, public infrastructure construction, and urban village renovation, such as the launch of the "three major projects", the market demand for construction steel is expected to be higher in January, long products accounted for a rise.

From the manufacturing PMI (Purchasing Manager's Index) and construction business activity index changes, steel consumption structure (leading one month) fluctuations and its strong correlation. The manufacturing PMI and plate and strip ratio (one month ahead) correlation is high, construction business activity index and long steel consumption ratio (one month lag) correlation is high.

In January, steel sales varieties accounted for a higher variety of hot rolled steel coil (hot rolled steel sheet, medium-thickness wide steel strip, hot rolled thin and wide steel strip, hot rolled narrow steel strip, after the same) accounted for 30.6%, wire rod (rebar, coils, after the same) accounted for 29.8%, medium-thickness plate (extra-thick plate, thick plate, medium plate, after the same) accounted for 12.9%.

From the point of view of subdivided varieties of categories, in January, medium-thickness wide steel strips accounted for the volume of year-on-year, rings are all down, respectively, 1.6 percentage points, 0.6 percentage points; rebar fell by 0.7 percentage points year-on-year, but the ring rose by 2 percentage points; coils year-on-year, ring are up. The data show that the proportion of long products has rebounded after a sustained decline.

Export volume increased by 28.8% year-on-year

In January, steel enterprises exported 2.688 million tons of steel, with an export ratio of about 4.35%, and the export volume increased by 28.8% compared with the same period in 2023. Among them, plate and strip, long steel, pipe, steel for railway and other steel were exported 1.815 million tons, 596,000 tons, 129,000 tons, 53,000 tons and 95,000 tons, accounting for 65.48%, 21%, 7.14%, 2.94% and 3.44% respectively.

In January, the export volume of higher varieties of hot rolled coil, plate, and section steel products, respectively, 898,000 tons, 417,000 tons, 326,000 tons, and exports accounted for the proportion of their respective sales of 4.7%, 5.2%, 5.1%. Steel for railroads and seamless welded pipes accounted for a relatively high proportion of export sales.

In January, the export growth of larger varieties of hot rolled steel coil was up 146.3%, and coated plate and seamless steel pipe exports fell 7.6%, 14.2% year-on-year.

The phenomenon of "northern materials going south" continues

In January, steel domestic sales in accordance with the regional inflow, East China inflow accounted for 45.7%, North China inflow accounted for 20.5%, South Central inflow accounted for 19.7%, Southwest inflow accounted for 7.5%, Northwest, and Northeast inflow accounted for about 3.3%. At the end of the year, the "north material south" phenomenon continues, North China, and Northeast China inflow accounted for a decline, and East China, and Southwest China inflow accounted for a rise.

From the flow of year-on-year data, in January, East China, Central and South China inflow accounted for an increase of 2.6 percentage points, 0.8 percentage points, North China, and Northeast China fell 1.8 percentage points, and 1.1 percentage points, showing that the East China, Central and South China's economic stabilization momentum is relatively better than the other regions.

From the inflow of varieties of structures, railway materials in North China accounted for a relatively high inflow; long steel, plate and strip materials in East China accounted for the highest proportion; pipe, East China, and North China accounted for basically equal.

Market accumulation of inventory is more obvious

At the end of January, steel inventories were 17.12 million tons, a decrease of 50,000 tons from the end of December 2023, with inventories at a recent low level. From the perspective of the inventory structure, the varieties of steel mills with large inventories are mainly wire rod, section steel and hot rolled coil.

From the steel association to monitor the steel social inventory, at the end of January 5 major steel varieties of social inventory totalled 8.66 million tons, an increase of 1.37 million tons compared with the end of December 2023, and inventory rose sharply. Due to the impact of the Spring Festival holiday, end demand continued to shrink, and the market tired inventory is more obvious.

Post time: Mar-27-2024