In November, China's steel market demand was basically stable. Affected by factors such as the month-on-month decrease in steel production, steel exports remaining high, and low inventories, steel prices have turned from falling to rising. Since December, the rise in steel prices has slowed down and returned to a narrow range of fluctuations.

According to monitoring by the China Iron and Steel Industry Association, at the end of November, the China Steel Price Index (CSPI) was 111.62 points, an increase of 4.12 points, or 3.83%, from the previous month; a decrease of 1.63 points, or a decrease of 1.44%, from the end of last year; a year-on-year increase of 2.69 points, an increase of 3.83%; 2.47%.

From January to November, the average value of China Steel Price Index (CSPI) was 111.48 points, a year-on-year decrease of 12.16 points, or 9.83%.

The prices of long products and flat products both turned from falling to rising, with long products rising more than flat products.

At the end of November, the CSPI long product index was 115.56 points, a month-on-month increase of 5.70 points, or 5.19%; the CSPI plate index was 109.81 points, a month-on-month increase of 3.24 points, or 3.04%; the increase in long products was 2.15 percentage points greater than that of plates. Compared with the same period last year, the long product and plate indexes rose by 1.53 points and 0.93 points respectively, with increases of 1.34% and 0.85%.

From January to November, the average CSPI long product index was 114.89 points, down 14.31 points year-on-year, or 11.07%; the average plate index was 111.51 points, down 10.66 points year-on-year, or 8.73%.

Rebar prices rose the most.

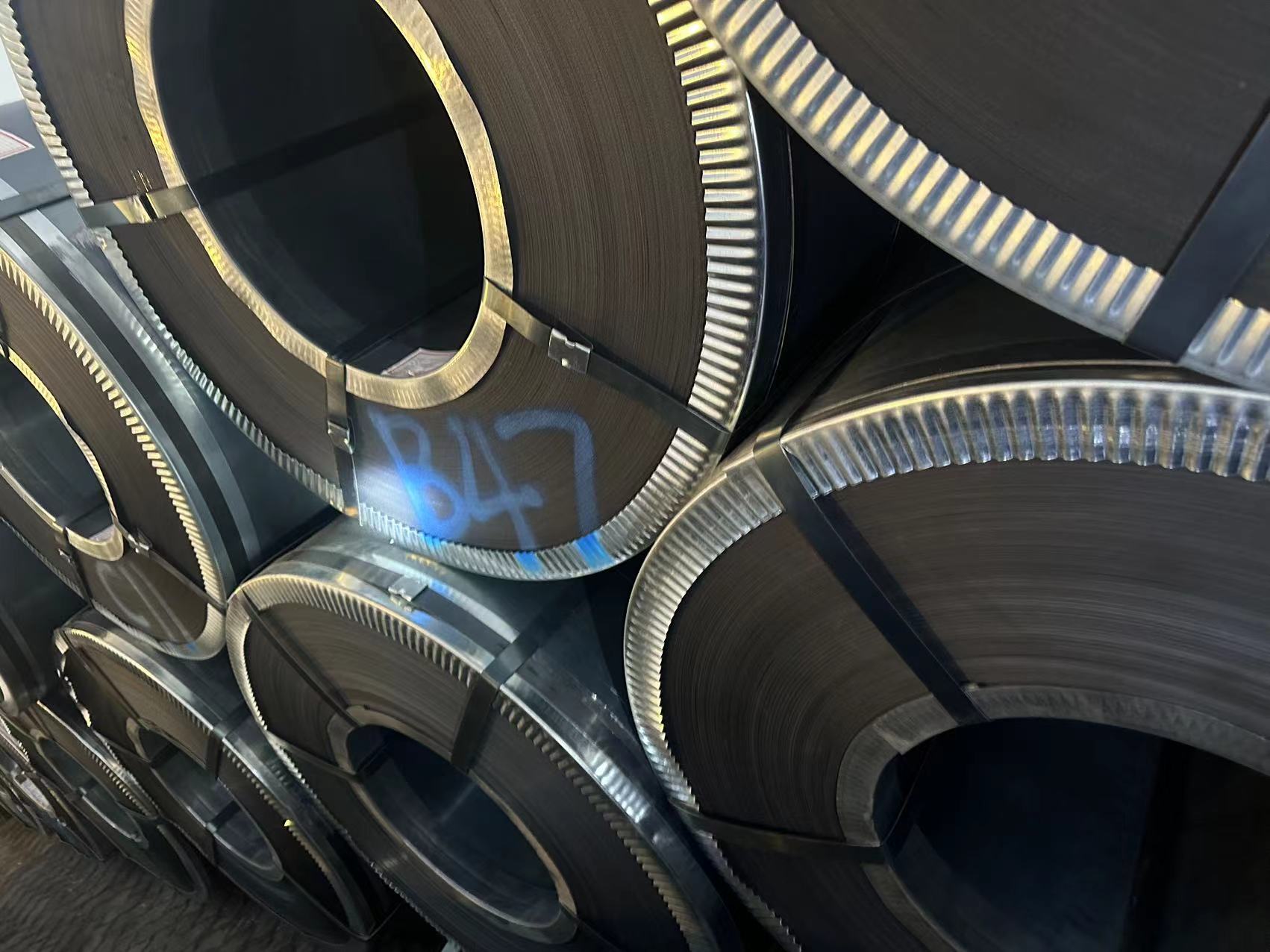

At the end of November, the prices of the eight major steel products monitored by the Iron and Steel Association all increased. Among them, the prices of high-wire steel, rebar, cold rolled steel sheets and galvanized steel sheets continued to rise, with increases of 202 rmb/ton, 215 rmb/ton, 68 rmb/ton and 19 rmb/ton respectively; angle steel, medium-thick plates, hot rolled steel plates The prices of coil plates and hot rolled seamless pipes turned from falling to rising, with increases of 157 rmb/ton, 183 rmb/ton, 164 rmb/ton and 38 rmb/ton respectively.

The domestic steel comprehensive index rose week by week in November.

In November, the domestic steel comprehensive index rose week by week. Since December, the increase in the steel price index has narrowed.

The steel price index in the six major regions all increased.

In November, CSPI steel price indexes in the six major regions across the country all increased. Among them, East China and Southwest China experienced larger increases, with month-on-month increases of 4.15% and 4.13% respectively; North China, Northeast China, Central South China and Northwest China experienced relatively smaller increases, with increases of 3.24%, 3.84%, 3.93% and 3.52% respectively.

[Steel prices in the international market turn from falling to rising]

In November, the CRU International Steel Price Index was 204.2 points, a month-on-month increase of 8.7 points, or 4.5%; a year-on-year decrease of 2.6 points, or a year-on-year decrease of 1.3%.

From January to November, the CRU International Steel Price Index averaged 220.1 points, a year-on-year decrease of 54.5 points, or 19.9%.

The price increase of long products narrowed, while the price of flat products turned from falling to rising.

In November, the CRU long product index was 209.1 points, an increase of 0.3 points or 0.1% from the previous month; the CRU flat product index was 201.8 points, an increase of 12.8 points or 6.8% from the previous month. Compared with the same period last year, the CRU long product index fell by 32.5 points, or 13.5%; the CRU flat product index increased by 12.2 points, or 6.4%.

From January to November, the CRU long product index averaged 225.8 points, down 57.5 points year-on-year, or 20.3%; the CRU plate index averaged 215.1 points, down 55.2 points year-on-year, or 20.4%.

The steel price index in North America and Europe turned from falling to rising, and the decline in the Asian steel price index narrowed.

North American market

In November, the CRU North American steel price index was 241.7 points, up 30.4 points month-on-month, or 14.4%; the U.S. manufacturing PMI (Purchasing Managers Index) was 46.7%, unchanged month-on-month. At the end of October, the U.S. crude steel production capacity utilization rate was 74.7%, a decrease of 1.6 percentage points from the previous month. In November, the prices of steel bars and wire rods at steel mills in the Midwestern United States declined, the prices of medium and thick plates were stable, and the prices of thin plates increased significantly.

European market

In November, the CRU European steel price index was 216.1 points, an increase of 1.6 points or 0.7% month-on-month; the initial value of the Eurozone manufacturing PMI was 43.8%, an increase of 0.7 percentage points month-on-month. Among them, the manufacturing PMIs of Germany, Italy, France and Spain were 42.6%, 44.4%, 42.9% and 46.3% respectively. Except for Italian prices, which fell slightly, other regions all turned from falling to rising month-on-month. In November, in the German market, except for the price of medium and heavy plates and cold-rolled coils, the prices of other products all turned from falling to rising.

Asia market

In November, the CRU Asian Steel Price Index was 175.6 points, a decrease of 0.2 points or 0.1% from October, and a month-on-month decrease for three consecutive months; Japan's manufacturing PMI was 48.3%, a month-on-month decrease of 0.4 percentage points; South Korea's manufacturing PMI was 48.3%, a month-on-month decrease of 0.4 percentage points. 50.0%, a month-on-month increase of 0.2 percentage points; India's manufacturing PMI was 56.0%, a month-on-month increase of 0.5 percentage points; China's manufacturing PMI was 49.4%, a month-on-month decrease of 0.1 percentage points. In November, the prices of long plates in the Indian market continued to fall.

Main issues that need attention in the later stage:

First, the periodic contradiction between supply and demand has increased. As the weather further turns colder, the domestic market enters the off-season of demand from north to south, and the demand for steel products drops significantly. Although the level of steel production continues to decline, the decline is lower than expected, and the periodic supply and demand contradiction in the market will increase in the later period.

Second, raw and fuel prices remain high. From the cost side, since December, the rise in steel prices in the domestic market has narrowed, but the prices of iron ore and coal coke continue to rise. As of December 15, the prices of domestic iron ore concentrate, coking coal, and metallurgical coke, respectively Compared with the end of November, they increased by 2.81%, 3.04%, and 4.29%, which were all significantly greater than the increase in steel prices during the same period, which brought greater cost pressure to the operations of steel companies in the later period.

Post time: Dec-27-2023